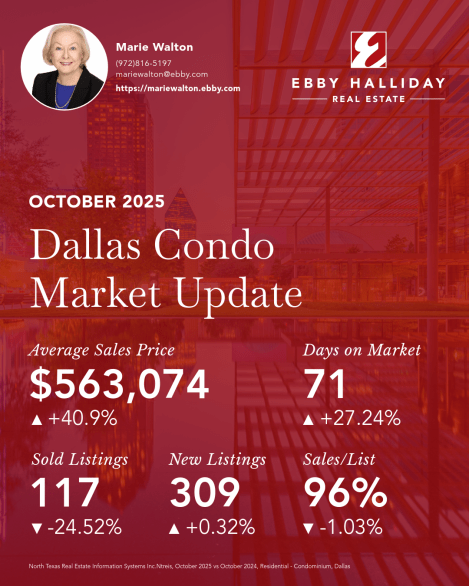

The market for condo sales in Dallas, TX, during October 2025 is undergoing a period of significant adjustment, contrasting sharply with the highly competitive environment experienced in previous cycles. This segment is currently presenting the most pronounced shift in the Dallas real estate spectrum, moving toward conditions that significantly favor the buyer.

Analysis of transactional velocity reveals a substantial decrease in sales volume, indicating that buyer demand is not keeping pace with the available supply. Concurrently, the median price for condominiums has experienced a measurable decline, signaling a market correction where sellers are being compelled to adjust their expectations downward to align with current buyer valuations.

Furthermore, a defining characteristic of this market phase is the substantial increase in the time properties are spending on the market, with the average days to sell being notably extended compared to other housing types. This metric is compounded by a surge in the overall months of inventory, which has expanded to levels indicative of a buyer’s market. This oversupply grants potential purchasers a wider selection and significant leverage in negotiating terms, concessions, and final pricing.

Comments for Stakeholders:

For Prospective Buyers:

This is a distinctly advantageous period for acquisition. The significant increase in inventory and the extended days on market offer an optimal window to conduct thorough due diligence and engage in robust negotiations. You possess considerable leverage to secure favorable pricing and terms, including potential seller concessions for closing costs or rate buydowns. Prudence suggests focusing on well-maintained properties that are priced realistically for the current climate.

For Current Sellers:

The prevailing market conditions necessitate a strategic re-evaluation of pricing strategy. Overpricing in this environment directly contributes to prolonged market exposure and necessitates deeper price reductions later in the sales cycle. Success hinges on aggressive and accurate initial pricing, impeccable property staging, and a willingness to offer incentives to differentiate your unit from the high volume of competitive inventory. Flexibility in negotiations is paramount to achieving a timely disposition.

|

|

|